The 25K Challenge

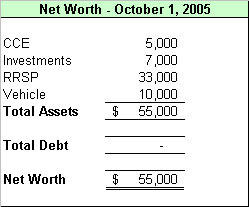

I'm 29 years old and up until this point in my life, I haven't exactly been living a frugal life. I have managed to acheive on average a 25% savings rate since I entered into the workforce 5 years ago and have so far accumulated a modest net worth of $55,000. I recently started reading some finance blogs indicating that an individual should strive for a 10% savings rate, so I initially gave myself a pat on the back. It wasn't until I looked at some other sites in detail, that I realized there were a lot of other individuals at my age with a much higher net worth ranging from 150-180K.

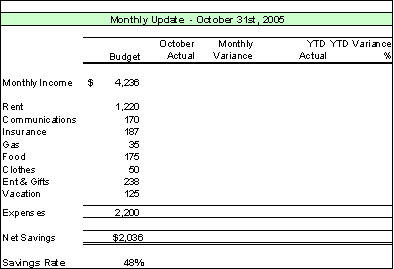

I'm 29 years old and up until this point in my life, I haven't exactly been living a frugal life. I have managed to acheive on average a 25% savings rate since I entered into the workforce 5 years ago and have so far accumulated a modest net worth of $55,000. I recently started reading some finance blogs indicating that an individual should strive for a 10% savings rate, so I initially gave myself a pat on the back. It wasn't until I looked at some other sites in detail, that I realized there were a lot of other individuals at my age with a much higher net worth ranging from 150-180K.I currently rent an apartment in Toronto. The housing market has escalated to the point where homes boast a price tag of $300,000 for an entry level home in a somewhat decent, yet not desirable neighbourhood. With a near term goal of purchasing a house in the next year or two, I am challenging myself to save $25,000 per year. This represents a savings rate of 48% of my after tax earnings. To do this, I developed a budget and will track my monthly progress and report on it.

Notes and assumptions

Monthly income - net after tax with an effective tax rate of 30%.

Rent - The largest component of my spending budget at 54%; possibly subject to a 3% annual increase. I was able to convince my landlord to not implement the increase in 2005. This was achievable only because rental vacancies are high due to the ongoing housing boom.

Communications - includes monthly phone bill, internet and cable bill. Many of the financial blogs indicate one of the easiest ways to save money is to cancel the cable bill. This is not something I'll willing to compromise and consider these expenses essential. For me and my current lifestyle, a decrease in my internet or cable bill would be offset by an increase in entertainment costs. I have set myself up on a "bundle plan" and plan to try a cancellation tactic in hopes of a decreased price. There is a great post on how to achieve this: MyMoneyBlog. I'm just trying to gather the nerve to pull off this total bluff.

Insurance - Car, apartment and health insurance. I'm currently looking into increasing my deductible on car which should produces some savings. Unfortunately my employer does not offer a group health plan causing me to spend 2% of my budget on private health insurance

Gas - I walk to work everyday and use my car mainly for out of town trips, which I take approximately once a month to visit family and friends. I rely almost exclusively on foot and public transportation. On average, I need to fill my car with one tank of gas per month.

Food - An average of $45/week which will be a challenge. As a vegetarian I can save a little in this area without having the high expense of meat in my budget. This category includes groceries only. Because I live so close to my work location, I eat my lunch at home(the equivalent of brown-bagging it). Note that "eating-out" is captured in the entertainment category.

Clothing - A budget of $600 per year. I generally do a big shop twice a year in the spring and fall to maintain my current wardrobe.

Entertainment and Gifts - An average of $60 per week which will allow for 1.5 nights of entertainment per week. I play in team sports three times a week which helps keep these costs low. That is of course, as long as I don't go out for beer afterwards.

Vacation - One $1,500 vacation per year. If I'm going to save 48% of my income, I deserve a vacation at the end of the year.

If I am able to maintain this budget I will have saved $24,432 in one year. I hope to achieve a return on investment on my existing portfolio and new savings of 5% after tax which will put me over my $25,000 goal. My first progress report will be posted October 31st - the first full report of my new life as the Frugal Canadian.

1 Comments:

I really encourage you to look closely at your communications line item. I too can't live without my cable tv. I managed to save by making a simple call to the retention department of my cable company (I have bundled cable and broadband service). You might try that if you can't work up the nerve to do the bluff option (I couldn't quite do it myself).

If you don't already use VOIP I suggest you look into it. I am amazed at how much it saves me and it is so nice to know I have a fixed low cost unlimited calling plan at home.

Post a Comment

<< Home