Second Quarter in Review

3 months since my last post. Not exactly what I envisioned but I've been pretty busy. Despite the end of personal tax season, I have been extremely busy at work working on corporate year ends and in my spare time I've been wedding planning and enjoying the summer.

Here's what I've been up to over the past 3 months

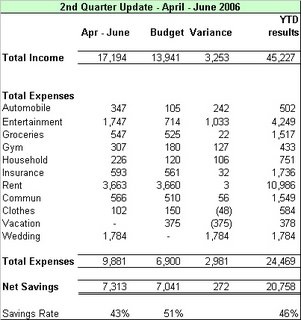

- A savings rate of 43%, excluding wedding expenses a savings rate of 53%

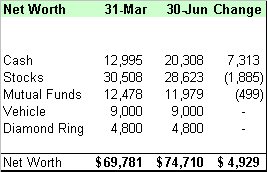

- My investments have lost 5.5% or $2,400 since March 31st. This actually had been closer to 10%, but thanks to the late week rally after Bernanke's 25bps rate increase, I recovered some of the losses.

- I've got $20,000 in cash, earning 3.1%. I'm looking into improving this by considering the Altamira Cash Performer which Canadian Capitalist talked about this week. I won't be using my brokerage account but rather will invest directly with Altamira by linking to my chequing account, so I am not concerned about the redemption fees. I am also considering the GIC ladders but for my very short-term time frame I don't think it will be worth the hassle.

1 Comments:

One comment about including a vehicle in a net worth statement - have you considered depreciating its value monthly? I actually consider a car to be a liability and don't include it in my net worth calculations. The exception to this is if you are making payments on a vehicle - using some declining value to offset the loan amount is prudent. Just a thought.

Post a Comment

<< Home