Monthly Savings and Net Worth Update

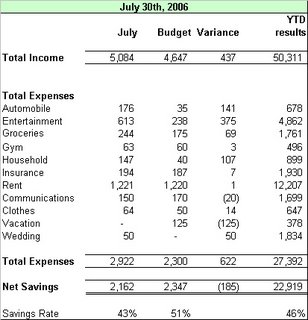

I had a savings rate of 43% or $2,162 this month. I overspent across the board this month. Some large spending items included:

- Renewal of CAA membership of $60. In May I killed my car battery. CAA arrived within the hour when I called and I had a new battery installed in minutes. While I am sure I was overcharged for the battery by approximately $40, the alternative would have been to have 3 hours of lost work which was worth the cost to me and justified me renewing the membership.

- Close friends birthdays, family gifts and baby gifts cost me $150.

- Other night outs with friends and other entertainment costs over spending $225.

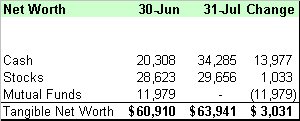

My portfolio rebounded by gaining $869 vs last month. I sold my mutual funds which I've been meaning to dump for a long time now. They have had mediocre returns with high MERs. I'm now looking for a Canadian index ETF(likely XIU which I'll buy on a market dip), and likely will get into some US defensives.

I've changed my net worth statement to reflect only my Tangible Net Worth. As a result, I've excluded my vehicle and diamond ring as these items really have no tangible net worth to me. I'm not planning on selling either ever and my car will be driven until it has no value and is depreciating rapidly.

4 Comments:

i noticed something very odd cynthia. what is your decision not to use RRSPs and insead keep all your stocks and mutual funds outside an RRSP? Don't you want the tax savings. Please advise.

Peter Buhr

Your cash position is fairly high (~33% of your worth before you sold the funds in Jul). Assuming you are keeping emergency cash for up to 3 months or rule of thumb ~$10,000. I'm curious to why not invest the other $10,000 cash?

My cash position is high for a few reasons:

- I'm getting married in the fall which I know there are going to be a lot of expenses coming up.

- I just sold 13K of mutual funds which have yet to be reinvested

- I'm planning on buying a house within one year and therefore don't have a LT investment horizon to tolerate any adverse price movements. I'm earning 4% on my cash which is around the best rate of a 1 year GIC

Re: my RRSPs. I do have RRSPs, a combination of stocks and cash. I just don't list it separately on my net worth statement because I view my portfolio as a whole, rather than individual accounts as a mental accounting exercise. I always contribute enough to my RRSP to get down to a 35% tax bracket

And Peter - who is cynthia?

wow net savings of 43% and you can still save 47%. You must make like 90K you are rich. Respekt. -BJ

Post a Comment

<< Home