February Savings Update

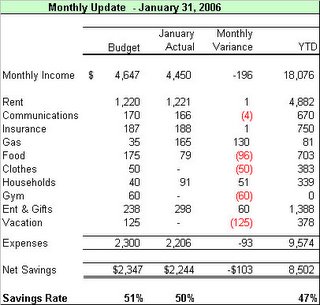

I saved 48% of my income this month for a total of $2,128 and overall have saved $10,630 since I started the 25K challenge.

I saved 48% of my income this month for a total of $2,128 and overall have saved $10,630 since I started the 25K challenge.While my expenses were pretty much on target, there are some room for improvement. I noticed this past month that I did the majority of my grocery shopping at Dominion which is much more expensive than the local NoFrills or IGA.

My excuse is that I'm working a lot of overtime(yeck - no overtime pay) during tax season and Dominion is just down the street from me. I think I easily could have cut about $20 out of my grocery spending if I had spent the extra time going to NoFrills or IGA. I'm not sure if this is exclusive to my local IGA store but there is a great "fast sale" produce section in the store. For the most part, there is good quality produce with only a few minor bruises for ridiculously low prices. It's not uncommon to get a package of vegetables such as eggplants and zucchini for $1 to $2.

I thought I'd do a chart to visualize where I'm spending my money. Not surprising, but discouraging, is that I spend 51% of my total expenses each month on rent. Rent also represents 27% of my after-tax income.

Entertainment, at 15%, is my second largest expense and something that I could control but also find the hardest area to find ways to cut corners. Statistics Canada has some interesting numbers of the average household expenditures. Based on Toronto's 2004 figures reported, I've estimated that the average household spends 12% of expenses on entertainment. I've derived this number to exclude personal taxes and pension contributions to compare with my figures.(1) The report also indicates 18% for transportation costs, so I'm clearly not an average household income. Still I'd like to find a way to reduce these costs slightly.

(1) - My income figures are net of tax and therefore incorporate taxes as income not as an expense.